In the constantly evolving scenario of financial markets, traders are always aiming to adequately manage risks and protect their investments. The Chande Kroll Stop, a dynamic indicator, is one such tool that has acquired popularity because of its proficiency in helping traders define optimal stop loss locations. In this blog, we will explore the concept, merits, demerits, and components and it can be helpful to encourage or boost your profit in both long and short positions. It is already stated in their book “The New Technical Trader ”- boost your profit by plugging into the exclusive indicators.

Define Chadle Kroll:

The Chande Kroll Stop is a specialized analysis indicator that is used to specify the optimal placement of a stop loss order. It was introduced by Tushar Chande and Stanley Kroll, two admiringly honorable figures in trading in the mid-90s, and is knocked over by the concept of volatility.

What are the components of Chande and Kroll Stop?

The components are explained point by point below :

- High Stop and Highest Price Falls:

One of the main functions of the Kroll Stop is to recognize potential stop levels. It happens because it helps to track the highest price reached and adjust the stop when prices fall. It will help the traders to minimize losses.

- Long and Short Position:

The Chande and Kroll Stop nourish important guidance for traders who are in long and short positions. It helps to fit your trading direction, making it versatile

for different market conditions.

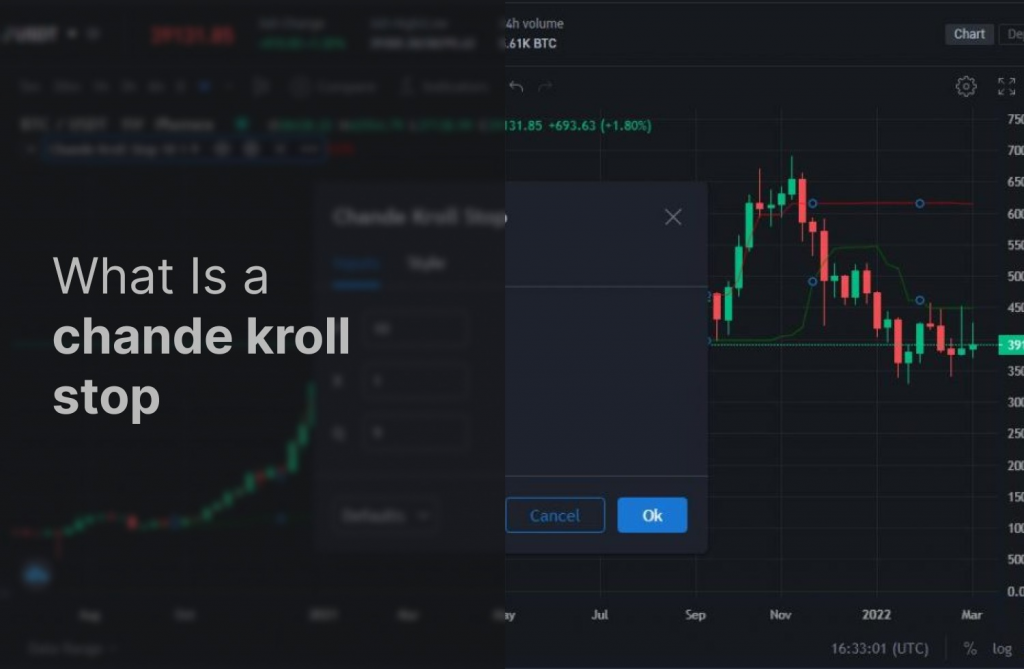

- Green line and Red line crosses:

These lines reflect the potential entry and exit points. It will make it easy for traders to act swiftly.

- Average true range:

It is extremely crucial to estimate the market volatility for effective risk management. The Chande Kroll Stop integrates the ATR (Average True Range) to grasp the market scenarios.

Calculation of Chande Kroll Stop:

It consists of 3 main elements are:

- The Average True Range (ATR): It represents volatility measures that are estimated by averaging true rangers over a specific time frame.

- The Multiplier:Typically set between 1 and 3, the multiplier modifies the ATR according to the trader’s risk tolerance.

- Price: The existing price of the security being analyzed.

The formula is stated below:

- Initial high stop = HIGHEST [p] (high) – x * Average True Range [p]

- Initial low stop = LOWEST [p] (low) + x * Average True Range [p]

- Shortstop = HIGHEST [q] (Initial high stop)

- Long stop = LOWEST [q] (Initial low stop).

Advantages of The Chande Kroll Stop:

- It is a dynamic indicator that helps to grasp when the price moves.

- It protects against sudden price fluctuations, thriving especially useful in volatile assets.

- It makes traders’ experience simple.

Disadvantages of The Chafe Kroll Stop:

- The indicator may be extremely responsive to price changes, which could result in early stop-outs and possibly lost opportunities.

- It could be less effective with low-volatility assets, making it inappropriate for some trading strategies or timeframes.

- Use of the Chande Kroll is not advised in isolation. It works best when used in conjunction with other technical indicators and analysis tools.

How to learn using the Chande Kroll Stop?

We have to be attentive to some sensitive areas like setup, stop-loss implementation, and entry signals.

- Setup:

The first step is to get adjusted to the risk tolerance and trading style which trader can follow.

- Stop loss implementation:

You can use the indicator as a dynamic stop-loss once you have selected your chosen parameters and added the indicator to your chart. You can place your order for a long position below the relevant level (the blue line), then change it as the indicator adjusts. Traders move it above the orange line when they are short.

- Entry Signal:

Although the Chande Kroll is a mainly stop-loss tool that helps to provide entry signals. Whenever the long-stop line strikes out the stop-line, the signal can be a bullish momentum. Conversely, the opposite can denote that a short position could be opened and that a short position could be opened.

Takeaway:

The Chande Kroll Stop is a dynamic tool which can be used by the traders’ for the important insights for the optimal stop loss and trend identification.By ensuring that stop loss levels are set at suitable intervals from current prices, the Chande Kroll Stop indicator protects traders’ capital while preserving the possibility of profit. Trading decisions can be improved by risk management tactics by comprehending the Chande Kroll Stop’s elements, computations, and real-world implementations.