From an economic point of view, it is important to understand the market structure before entering into a market. Even for someone who does not wish to enter the market, but wants to study the finer aspects of it, the driving factors and other forces at deployment which regulate the supply side of the market and determine the prices of the good, it is extremely important to understand the structure of the market. Is the market free and fair to enter for all? Is there a particular firm dominating the entire supply chain? Is there a cartel operating that drives the prices in the market? These are the questions that are essential to answer in order to understand the way in which aspects of a market work.

The market structure is broadly of four types – perfect competition, monopolistic competition, oligopoly, and monopoly. Two of the most common and real terms used to understand the market structures are Duopoly and Monopoly. While they do share similarities, most of the similarity is that both of them have a ‘poly’ at the end. In essence, the two market structures are very different from each other. Yet, people get confused about them and consider them to be the same. Here is detailed information about the two markets, their real-life examples, their advantages and disadvantages, and their similarities and dissimilarities.

What is a Duopoly?

A Duopoly is a market structure where two firms control the major share of a market. They may compete against each other or may collaborate with each other in order to decide the market prices and earn huge profits. What happens, in reality, is a mix of the two.

There is little or no competition from other firms threatening to enter the market. The duopolists have immense control over the raw materials, and resources and hold patents in order to prevent the competitors from entering the market.

A duopolist must consider their opponent’s strategy and pricing game in order to set their own prices and supply quantities. A duopolist’s actions have consequences both for themselves and their opponent.

Types of Duopolies-

Duopoly is basically divided into 2 categories –

1. Cournot duopoly

In a Cournot Duopoly model, the two key players essentially divide the market share in half and take half of the market share each by competing in quantity. They keep an eye on the other player’s strategy, adjusting their own prices according to the change in the opponent’s tactics. By doing this repeatedly, an equilibrium is reached where both firms own half of the market share each and sell the product at the profit-maximizing price.

2. Bertrand Duopoly

Bertrand’s Duopoly model suggests that in a duopoly market, the consumers will prefer the firm which sells the goods at a lower price. So, the firms try to keep their price slightly below the price of the other firm. This leads to cutting down prices by both firms until the price is equal to the unit cost. In this case, both firms do not gain anything because their total profit is zero. No firm would set the price below the unit cost because that would mean a loss for them. So, the price equal to the unit cost becomes a weak equilibrium in this case.

Examples of Duopoly Stocks

Here are some examples of firms that operate in duopoly market structures:

1. Boeing and Airbus dominate the global aircraft manufacturing industry. and hold over 99% of the market share for large commercial aircraft.

2. PepsiCo and Coca-Cola dominate the global carbonated soft drink industry. they hold over 75% of the market share for carbonated soft drinks.

3. Visa and Mastercard dominate the global credit and debit card industry. They cover over 85% of the market share for credit and debit cards.

Advantages of Duopoly stocks

· Healthy competition

· The absence of other competitors

· More innovative goods and services

· Improved product quality for consumers

· Collusive cooperative equilibrium

Disadvantages of the Duopoly market

· Strong barriers to entry

· Lack of options for customers

· The possibility of collusion.

· The firms face a loss in cases of Bertrand duopoly

· The non-entry of competing firms can lead to the stagnation of a product market

What is Monopoly?

A monopoly is a market structure where a single firm holds most of the market share without any significant competitors. This allows the monopolist firm to set prices at any desired level and gain extreme economic profits. The monopolist has high power to set the prices and regulate the supply of the good in the market. Since there is no other firm operating, the customers have no option but to avail the goods or services of the monopolistic firm.

However, the higher the monopolist will set the price, the lesser customers it will have. So, the monopolist commonly sets the price where the marginal revenue equals the marginal cost in order to maximize the profit. In some cases, the monopolist sets the price above the marginal cost of production, known as the ‘monopoly markup’.

Examples of Monopoly Stocks

Here are some examples of firms that operate in monopoly market structures:

1. Microsoft Corporation dominates the global software industry through its Windows operating system, which is installed on over 80% of personal computers worldwide.

2. De Beers dominates the global diamond market through its control of diamond mines and their marketing and distribution channels.

3. The United Parcel Service (UPS) and FedEx hold a near-duopoly over the global package delivery industry, with over 50% of the market share between them.

Key examples to note:

We are also listing down a few key examples you should refer to better understand the concepts.

Marico is one of the well-known FMCG companies in India, but the majority of its success lies in its two brands ‘Saffola’ and ‘Parachute’. The company is only 30 years old, yet it holds a significant market share. ‘Safola’ holds a share of an impressive 73% in the market of premium edible oil. The brand ‘Parachute’ also holds its dominating market share of 59%. These two brands contribute nearly 90% of the company’s profits.

Coal India Limited, which is an India-based coal mining and refining company, is the world’s largest coal-producing company. It is responsible for the production of nearly 82% of the coal in India. However, the government of India announced that this year, the coal mining sector would also be made open for commercial mining, which could be a signal at ending the monopoly of Coal India Limited in the Indian coal market.

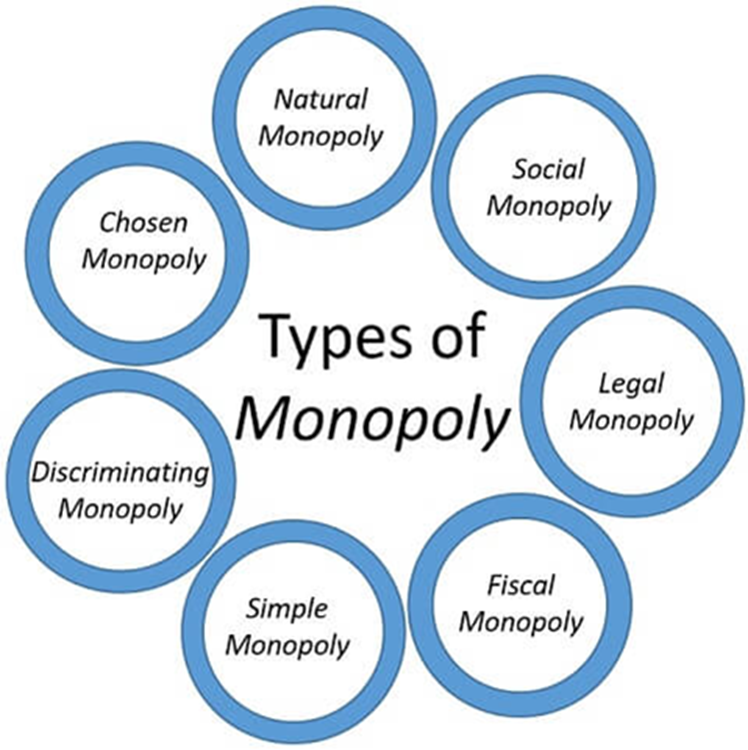

Types of Monopoly

Differences between Duopoly and Monopoly Stocks –

In a monopoly, the seller has complete control over the market and can dictate prices which cannot be done in the case of a Duopoly. In a monopoly, the entry barriers are high, making it difficult for new sellers to enter the market, and in a duopoly, the entry barriers are lower, making it easier for new sellers to enter the market and compete with the existing sellers.

Monopoly refers to a market structure where a single seller dominates the market and has the power to set prices which isn’t the case under a duopoly where there are two sellers in a market structure. In a monopoly, the seller has full control over the supply of goods and services in the market, and there are no close substitutes available to consumers. This means that the seller can charge a high price for their product. While duopolies can still result in higher prices for consumers, there is more competition compared to a monopoly. Monopolies can arise due to barriers to entry, such as high start-up costs, legal restrictions, or exclusive access to resources.

FAQs

1. Why are duopolies assumed to be more competitive than monopolies?

Duopolies involve two dominant firms that are competing for market share through product quality, innovation, and pricing. This competition can lead to lower prices and higher-quality products, ultimately resulting in increased consumer surplus.

2. What is the typical market share of duopolist firms?

Typically, duopolist firms have a market share of half each in the Cournot model as well as the Bertrand model. However, in the Cournot model, the firms gain some profit, but in the Bertrand model, they do not.

3. Why don’t monopolists charge infinite prices for goods if they have absolute control over the market?

Monopolists do not do so because the demand is a negative function of price. If the price is set too high, then nobody will buy the good or service unless it is an essential commodity. However, it is often seen that in extreme cases such as calamities, the prices of essential goods skyrocket to as much as twenty times.

4. What role do barriers to entry play in the creation of monopolies?

Barriers to entry, such as unique technology or intellectual property, can create a natural monopoly where the dominant firm has no significant competitors. In other cases, barriers to entry can be created through government-granted licenses or predatory tactics aimed at eliminating competitors.

5. Do the monopoly market affect job?

Because innovation and customer satisfaction aren’t as important in a monopoly market. Businesses may rely on outdated activities and practices and hire fewer employees, which can influence the market.